Abercrombie's Latest Downward Spike Might Have Fans Worried

As we look back to the 2000s with nostalgia, shopping at the local mall was a way of life as a teenager for many millennials. From the warm, mouthwatering smells of Cinnabon to the uplifting floral scent of Japanese Cherry Blossom coming from Bath and Body Works, there are so many pleasant memories from what many consider to be simpler times. However there's one scent that is absolutely unmistakable for many former mall mavens — Abercrombie & Fitch.

Previously known for loud music and a strong woodsy cologne aroma, one would have wondered if they had entered a nightclub. Now the store has made many changes and is almost unrecognizable. In 2014, Abercrombie transformed its business model by selling black clothes and eliminating sexualized marketing (per Insider). Time reports the clothing company reduced the cologne sprays by 25% along with adjusting other issues like music and lighting. According to Seventeen, the store also replaced their choice cologne called "Fierce" with "Ellwood" — a gender-neutral scent.

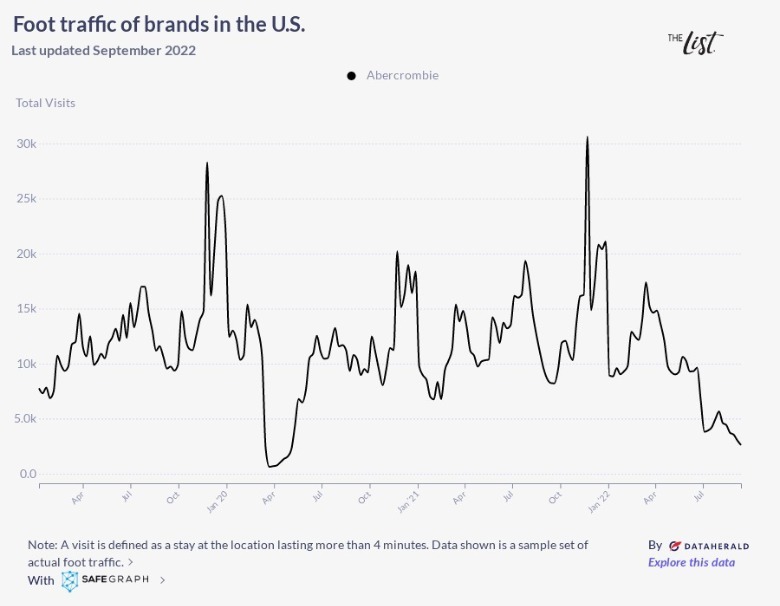

When new CEO, Fran Horowitz, took over in 2017, she implemented a number of business strategies including brand differentiation between Abercrombie & Fitch (A&F) and sister brand Hollister, as well as adopting a more sophisticated marketing approach (per Fortune). Many like Teen Vogue have lauded the changes, calling the brand "cool again." However, The List charted foot traffic data of U.S.-based Abercrombie stores via Safe Graph, and it unfortunately looks like the brand's sales may be taking a downturn.

Inflation and supply chain issues are hindering Abercrombie

Our data shows that Abercrombie's changes proved to be successful initially. The week of Christmas 2019 saw 25,242 shoppers across U.S. Abercrombie stores. While the company saw a major dip in foot traffic during the 2020 COVID-19 lockdowns, sales rebounded back to $1.56 billion in 2021 — their best numbers since 2014. During the week of Thanksgiving 2021, 30,627 shoppers went to Abercrombie stores. December saw an average of roughly 20,000 shoppers a week. In March, RetailWire reported that A&F had the "highest operating margin in over a decade" and was opening more stores than closing, which hadn't happened since 2008.

By May, things took a turn when Abercrombie's shares dipped by 29% and the company reduced their sales projection (via CNBC). Recent data shows foot traffic dropped to their lowest numbers since mid-May 2020 — with only 2,589 shoppers for the week of September 12, 2022. According to Seeking Alpha, a number of factors may be to blame including lower consumer confidence, Hollister's poor performance, and inventory issues. Due to previous supply chain shortages holding up goods, Abercrombie now has an abundance of inventory that has finally come to them. However, demand has decreased due to inflation, which has resulted in stock not moving. Seeking Alpha predicts Abercrombie may need to start putting older inventory on sale to boost demand. For Abercrombie fans, hopefully this means we can expect some amazing upcoming holiday sales!