Will The Delta Variant Cause Another Used Car Shortage In 2021?

Buying a used car was previously a relatively easy thing to do. You walked into a lot, priced the model you wanted, got your mechanic to make sure everything was working properly, cut the deal, and left.

But like many tasks we took for granted, the coronavirus pandemic made buying a used car not only more expensive, but also more challenging — simply because there aren't enough used cars to go around, and that has to do with the global microchip shortage.

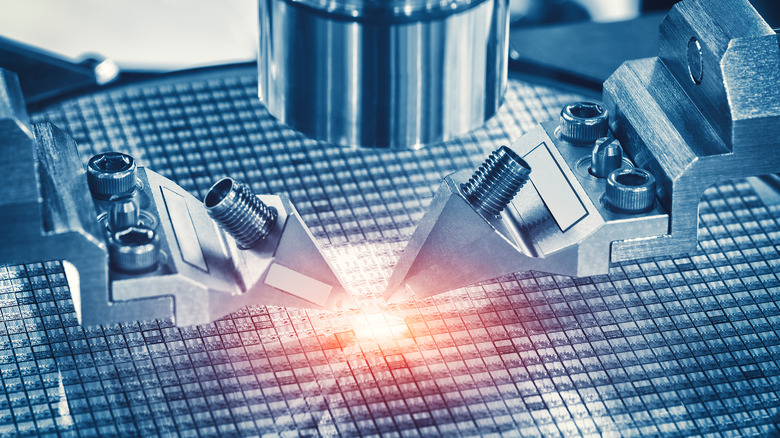

Most of us may know them as tiny pieces of silicone with wires on them, but to the manufacturing sector, they are the building blocks of just about everything we use today, from household appliances like refrigerators and washing machines to computers. These microchips act as small electric switches that either store or process information so that specific tasks can be done. In 2019, factories around the world generated more than 634 billion chips — powering an industry worth hundreds of billions of dollars (via ASML). But that was then, and this is now.

The pandemic fueled global demand for microchips

Having factories make more than 600 billion chips a year might sound like a lot, but Bloomberg reports that a combination of factors saw global chip demand shoot up in 2020 — and it wasn't all driven by the pandemic either. Part of the chip shortage was triggered by the sanctions the Trump administration imposed on China that year. When Chinese tech company Huawei found out that sanctions were looming, it and other Chinese tech companies started hoarding chips, triggering a shortage that manufacturers hadn't anticipated.

Demand for chips also rose when we all got hit with stay-at-home orders, and we sought out gadgets from laptops, gaming consoles, and webcams to TVs and air purifiers to keep our stay-at-home selves both occupied and healthy. That demand wasn't planned either, and so it also succeeded in squeezing manufacturers in a way no one had planned or foreseen.

But it wasn't enough that demand was on the rise. The global chip output was hurt by the Texas cold snap in February 2021 which cut chip manufacturing, as did a fire at a major chip manufacturing company in Japan.

The global chip shortage has impacted the used car industry

You might ask — what do used cars have to do with these shortages? Bloomberg's answer to that would be: a lot. While chip shortages ate into smartphone and appliance manufacturing, it also hurt car manufacturers, who were among the worst hit by ongoing chip shortages. This is not surprising because up to 40% of car models made in 2020 rely on chips to keep them on the road. As industry analyst Ed Kim tells USA Today, "The sheer number of chips that go into a modern car nowadays is staggering."

It doesn't help that the Delta variant, which surged across many Asian countries responsible for producing chips that are being used in cars around the world, has put an even bigger squeeze on chip supplies. To make matters worse, automakers are beginning to see other shortages in spare parts like wiring harnesses (via Interesting Engineering).

The pandemic is impacting used car supply in a strange way

All these shortages mean fewer new cars are hitting the road, which also means that fewer used cars will be leaving their owners' garages anytime soon. It also means that the difference in the price of a new car and a used one is now smaller than what it used to be (via Cars).

Until more chips are made and the global supply shortage is eased somewhat, there is no sign that more cars will be hitting the road. The Delta variant-driven shortage in Asia has already succeeded in shuttering General Motors plants across the country. "COVID is driving supply constraints in countries that produce semiconductor chips," GM spokesman Dan Flores tells USA Today. "But I can't say if it's because employees have a high rate of infection or if it's the government putting restrictions on plants due to the pandemic."

So if you're looking to upgrade or downsize, now may not be the time to do it.