Data Shows Walmart's Having A Harder Time Than We Thought

Walmart celebrates its 60th anniversary this year. Founded by Sam Walton in 1962, the national retail corporation has more than 10,500 stores worldwide, selling everything from clothes to groceries and even electronics, all in one reasonably priced superstore (via Walmart). While shoppers these days appreciate the convenience of shopping online, Forbes reports that "shopping in person remains a strong preference for many consumers," and stores rely on brick and mortar locations to provide an in-person experience that encourages people to indulge in the company's inventory. Although it may seem like there's a Walmart on every corner, recent data shows that shoppers have not been visiting the discount store as often as they once had.

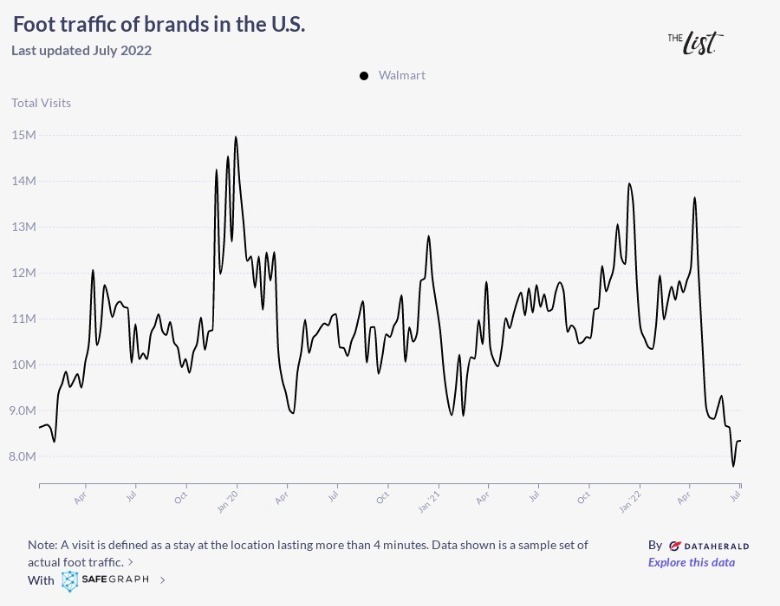

The List created a graph with exclusive data that mapped out the amount of monthly shopper visits to Walmart over the past two years. The graph defines a shopper visit as "a stay at the location lasting more than four minutes," revealing shocking data about how Walmart has recovered from the COVID-19 pandemic, and how recent trends could predict Walmart's future.

Who is to blame for Walmart's lack of visitors?

Based on the data collected by The List, foot traffic at Walmart took a major dive to less than 9 million visitors around May of 2022, a drastic change from the nearly 14 million visitors recorded the month prior. Visitor counts continued to fall the following July, with numbers falling below 8 million. This dip in shoppers illustrates Walmart's lowest amount of monthly shoppers in two years, with fewer people shopping at Walmart this summer than in the spring of 2020, at the height of the COVID-19 pandemic restrictions. It is clear that the strict social distancing measures and reduced shopping capacities did not affect Walmart's visitors in the long run, but they still played a major part in shifting consumer mindsets; post-pandemic spending habits may actually be to blame for Walmart's poor attendance.

According to The Washington Post, shoppers emerging from lockdown became less interested in spending money on goods and more interested in services and experiences, leaving stores with an excess of inventory. It is also worth noting that Walmart's foot traffic fell drastically during the same time that record-breaking inflation began, severely affecting consumer spending habits. The New York Times reports that Walmart saw its stock drop 7.6% after inflation began to rise, and is seeing an influx of shoppers that have been "shifting to cheaper, lower-margin products." Gas prices and essential goods have skyrocketed, leaving Walmart customers unable to shop as leisurely and frivolously as they once had.